For firms that require professional liability, making sure that you have the correct coverage form can be problematic. Policy language, terms, exclusions, and definitions are not standard. Something as simple as the correct definition of "Professional Services" can make the difference between obtaining coverage or receiving a coverage denial.

Our Professional Liability and Management Liability Practice has the expertise to negotiate the right terms and conditions for your specific need, tailoring coverage to suit your business' exposure.

These experts bring the same process to Management Liability coverages including Directors’ and Officers’, Employment Practices, and Fiduciary Liability.

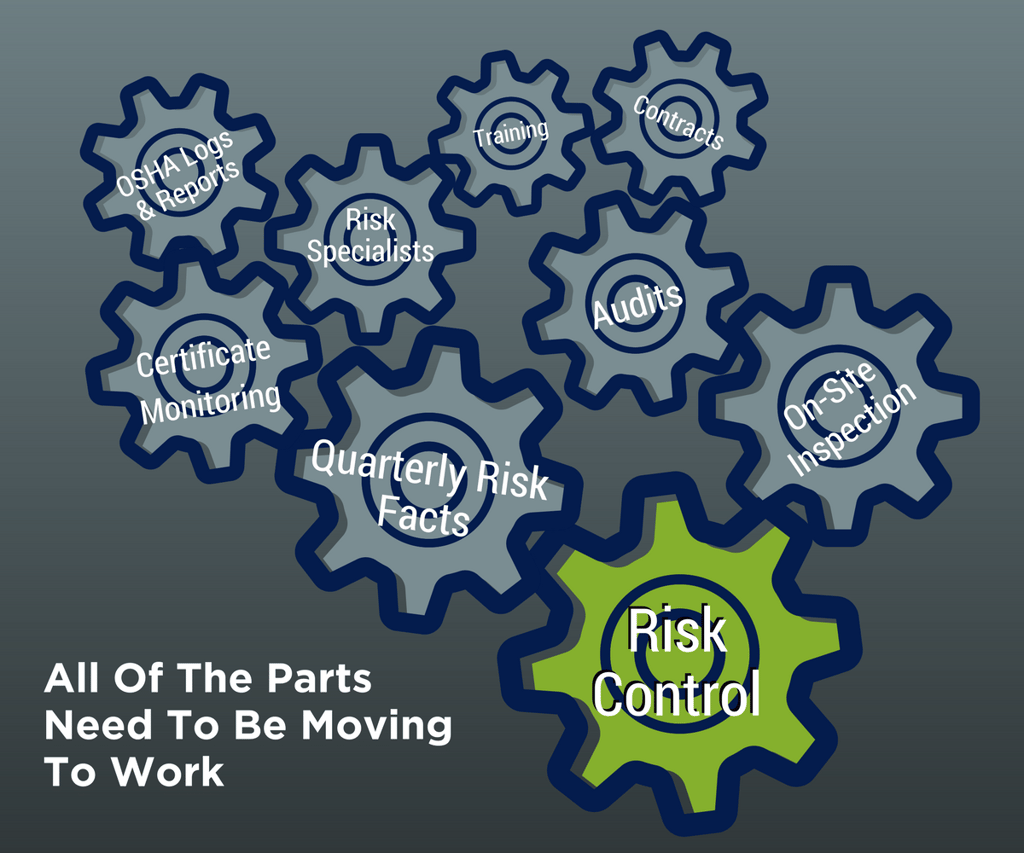

Through strategic partners, we can connect clients to loss prevention and reduction tools that eliminate or decrease loss potential.

We have developed a sophisticated team of experts in Workers’ Compensation, General Liability, and Property claims management.

We base these decisions on your corporate culture, appetite for risk, cash flow, and financial needs.

ECBM can also provide extensive independent consulting for a variety of other risk management needs.

|

|

|||

Strategic advice about your organization's key business strategies including goals and setting benchmarks.

We develop a program that will protect your assets, reduce your exposures, and deliver cost savings.

We create a unique sales pitch for each client that has been shown to attract the best carriers.

Our internal, independent quality management team monitors for quality assurance.

Using the established benchmarks, we revisit your goals and objectives to gauge if your coverage needs modification as necessary.

You get more than an insurance policy